RSS/Atom Feeds

RSS/Atom Feeds

RSS/Atom feeds provide an alternative way of reading news, with the aid of specialized RSS/Atom reader software.

athexgroup.gr provides Atom 1.0 feeds for the following categories:

- Athens Exchange Group (ATHEX Group) announcements

- Companies announcements (via the Hermes system)

An additional feed for Financial Statements in PDF format is available to subscribers only. Please contact our Information Services department in order to obtain a subscription to this feed.

More feeds will be provided in the future.

You can subscribe to any of these feeds by means of any Atom 1.0 reader program, including (but not limited to) RSS Reader, RSS Owl, OMEA, as well as browsers and email clients, including Internet Explorer, Mozilla Firefox, Opera, Microsoft Outlook, and others.

HELEX GROUP

HELEX GROUP

Stock Markets Steering Committee - Athens Stock Exchange

| |  |

December 08, 2017

Stock Markets Steering Committee - Athens Stock Exchange

The Stock Markets Steering Committee of the Athens Stock Exchange has decided the Amendment of the ATHEX Exchange Rulebook and the concommitant modifications of the Trading Model of the ATHEX Markets, through the ATHEX Resolutions, that will be implemented at the latest by 3/1/2018, on the following subjects:

A. Amendements regarding the trading segments;

B. Amendements regarding adaptations to the new European capital markets regime (MiFID II / MiFIR);

C. Amendments of the assement of the market making in the Athens Exchange Securities Markets and publication of the relevant information.

On Sunday, December 10, 2017 the Mock Trading with the participation of the Members will take place for their systems, processes and technical readiness. Following the Mock Trading Session an announcement regarding the amendments that will be in place as of Monday, December 11, 2017 will take place.

A. AMENDMENTS REGARDING TRADING SEGMENTS

Abolition of the "Low Free float Category" and "Under Deletion" Trading Segments

Shares that are currently traded in the above trading segments will be transferred to the trading segments in which they were fulfilling the relative criteria during the last review, prior to the amendment coming in force.

The date that this will come into force will be announced by ATHEX.

B. AMENDMENTS REGARDING ADAPTATIONS TO THE NEW EUROPEAN CAPITAL MARKETS REGIME (MiFID II / MiFIR)

B1. ATHEX Rulebook Amendments

The provisions of the Rulebook are updated with regard to amendments due to MiFID ΙΙ / MiFIR as following:

1. The obligation for Members to comply to the ATHEX auditing processes regarding the due diligence assessment that ATHEX conducts for new Members wishing to become ATHEX Members is introduced. ATHEX also conducts yearly assessment of the organisational requirements compliance risk of its Members.

2. New requirements are introduced for Members wishing to provide to their clients Direct Electronic Access Services (DMA or Sponsored Access services).

3. A new obligation regarding Algorithmic transactions is introduced for ATHEX Members, which must, among others:

- Notify ATHEX regarding algorithmic trading, through the process defined by ATHEX, and inform ATHEX regarding any malfunction that is related to algorithmic trading

- Implement testing regarding the algorith proper functioning in the ATHEX test (UAT) system

- Comply with the specific technical requirements set by ATHEX regarding the identification of Algo trades or HFT trades.

4. A new obligation is introduced for ATHEX to keep available for the Hellenic Capital Market Commission, for at least five (5) years, details regarding orders on all Financial Instruments on which trades are concluded through its Markets.

5. A new obligation is introduced for ATHEX to provide for configuration per Member regarding the number of orders that are directed to its trading system.

6. A new obligation is introduced for ATHEX regarding the message time and time divergence of the OASIS trading system in accordance to UTC.

7. The price tick is amended and will be following the EU regulatory regime.

8. Additional fields at order entry level are introduced and are classified as:

- Mandatory fields

- Voluntary fields

9. Introduction of amendments in the Market Making regime, as following:

- In cases of non-declared Market Makers, when the conditions and criteria which define the market making activity are met, the rights and obligations for market making as defined in the ATHEX Rulebook will come into force.

- ATHEX will inform Members of any changes in their market making obligations at least one (1) month prior to such changes coming into force.

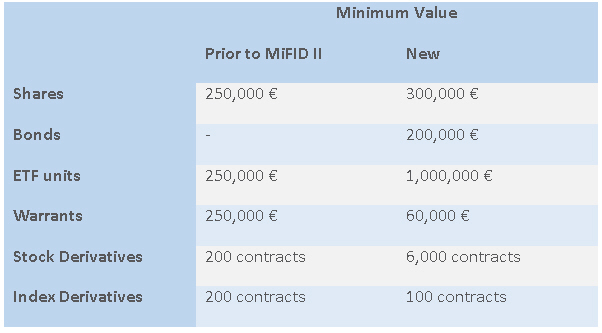

10. Introduction of amendments in the pre-trade transparency regarding the block trades value and exemptions as following:

|

11. Addition of the daily obligation of ATHEX to calculate the unexectued orders to trades ratio per financial instrument.

12. Improvement of the pre- and post-trade transparency of the ATHEX markets in accordance to the EU regulatory regime and the introduction of new requirements that improve the execution quality of trades in the ATHEX markets.

Regarding the changes for provisions: (7) Price Tick and (10) Block Trades, the date that they will come into force will be announced by ATHEX.

All other provisions will come into force on 03/01/2018.

It is noted that similar amendments are also introduced in the Rulebook of the Alternative Market of ATHEX, ENA.

Β.2. Amendments of Resolutions

ATHEX Resolutions which clarify in detail the amendments introduced in the ATHEX Rulebook are also being amended. In particular:

Β.2.1. RESOLUTION 1:

1. In Resolution 1 a new article is introduced which defines the organisational requirements for Members which make use of Algorithmic Trading, High Frequency Trading and a new article 6 regarding the DMA and Sponsored Acccess services.

A) In particular, it is defined that Members that are participating in ATHEX through Algorithmic Trading shall comply at any time with the requirements set for algorithmic trading and prior to concluding such trades should inform ATHEX by sending the following set of information:

- Algorithm name

- Algorithm ID

- Name of person responsible within Member

- Means of testing of the algorithm appropriateness

- Testing period

- Certification of the algo proper functioning

- Financial Instruments for which the algo will be used

- Date of commencement of use of the algorithm in the ATHEX trading system

The above will come into force on 03/01/2018. The declaration of the algorithms to ATHEX should be completed by 15/12/2017.

B) Regarding Direct Electronic Access (DEA), the Members must declare to ATHEX their intention to provide Direct market Access (DMA) or Sponsored Access (SA) services to their clients, prior to any activation of such services. In order to offer such services to clients Members are required to have in place a policy through which they can select and evaluate their clients for the provision of such services, which must at least include a written agreement for the provision of the service and records of the evaluation. The above will come into force on 03/01/2018.

C) Regarding the High Frequency Trading (HFT), it is mentionned that ATHEX will be providing to its Members, following their request, all required information regarding the number of messages that they introduce through Algorithmic trading for HFT. The above will come into force on 03/01/2018.

2. All provisions regarding the annual auditing of ATHEX Members are updated and the audit will include the full re-assesment of the Members compliance as well as specific comliance measures. The above will come into force on 03/01/2018.

Β.2.2 RESOLUTION 2:

In resolution 2 the range of the quote is amended in order to allow for the use of 4 decimals in accordance to the new price tick size. The date that this will come into force will be announced by ATHEX.

Β.2.3. RESOLUTIONS 10, 13 ,12 και 15

They are modified regarding the Minimum quantity for pre-agreed trades in derivative products and the date that this will come into force will be announced by ATHEX.

B.2.4. RESOLUTION 22

The amendments in the Resolution 22 are related to the trading procedures, as following:

1. Regarding the price ticks, the Resolution dictates that the price tick will follow the EU rules and will be published on the ATHEX web-site. It is noted that on the first day of implementation of the new price ticks adjustment, as will be announced by ATHEX, a rounding of the start of day prices for the stocks and the ETFs, at the nearest valid price tick will take place.

2. The Minimum values for the pre-agreed block trades (Method 6-1) for Bonds, ETFs, Warrants and Rights are specified and the date that will come into force will be announced by ATHEX.

3. The term of significant short term change of the price and volume simultaneously, is introduced for financial instruments that are classified as liquid and this measure will come into force as of 03/01/2018.

4. The pre-trade check for abnormally large order volume is defined and this check will come into force as of 03/01/2018.

5. The obligation of ATHEX to calculate the order to trade ratio is defined. This obligation will come into force as of 03/01/2018.

6. The new fields regarding the order entry are defined and will come into force as of 03/01/2018.

Mandatory fields:

1. Client ID

2. Investment Decision within firm

3. Execution within firm

4. Non Executing Broker

5. Direct Electronic Access (DEA)

6. Trading Capacity

Non-Mandatory fields:

1. XDIV reporting for specific trades with dividend

2. Duplicate reporting (DUPL)

7. The new Order Record Keeping requirements for storing and enriching Members orders through the new service (ORK) is defined and will come into force as of 03/01/2018.

It is noted that on the first day of the modifications, as it will be announced by ATHEX, all the life orders will be deleted from the Trading system.

C. AMENDMENTS REGARDING THE PARAMETERS OF THE MARKET MAKING EVALUATION MODEL FOR THE ATHEX CASH MARKET AND THE RELATED PUBLICATIONS

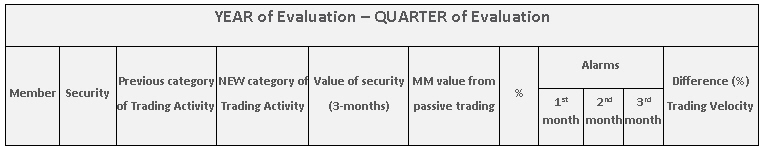

The amendment of Resolution 2 takes place regarding the Market Making Evaluation Model of the ATHEX Securities Market and its related publication on the ATHEX website, as following:

- The criterion "Value of orders to total trading value ratio (Q)", regarding the percentage for the stocks belonging to the High Trading Activity category is amended from Q>10% to Q>7%.

- The criterion "Value of orders to total trading value ratio (Q)", regarding the percentage for the stocks belonging to the Medium and Low Trading Activity category is amended from Q>10% to Q>5%.

- The criterion "Turnover Velocity improvement (V)" that applies only for the stocks of the Medium Trading Activity category, is amended from V=+0.02% to V=+0.01%.

All the evaluation criteria will be published in detail according to the following table:

|

The above amendments will be in force as of the Evaluation for the duration of the 1st quarter of the next year, hence 01/04/2018 and the publication of the Evaluation Table will be in force as of 03/01/2018.

| Download the Press Release |  |

About Athens Exchange Group

The Athens Stock Exchange since its establishment in 1876, consistently participate in the financial and business developments in the country.

Athens Exchange Group (ATHEX Group), provides support to the Greek Capital Market. ATHEX Group operates the organized Equities and Derivatves markets, the alternative market and performs clearing and settlement of trades.

The Athens Stock Exchange, through its markets, offers solutions and financing tools to businesses, expands investor choice by providing a safe, stable and easy environment in full alignment with international practices and the European regulatory framework. It has held the ISO 22301:2012 international standard for Business Continuity, for all its companies, including all its operations as well as the products & services it provides.

In a period that the role of stock markets in exploring alternative ways of financing business, at a European level, is significantly enhanced, the Athens Exchange Group has taken a series of initiatives to highlight the attractiveness of the Greek Capital Market and the Greek companies to the international investment community and expand the variety of investment opportunities.

Its shares are traded on the Main Market of the Athens Stock Exchange (Symbol: EXAE).

The profiles of the ATHEX Group and its markets can be downloaded from the link. More information can be found in the website www.athexgroup.gr.

110 Athinon Ave. 10442 Athens, Greece, tel +30-210 3366 800, fax +30 210-3366 101

ΙΝΤΡΑΛΟΤ_ΕΔ.pdf

ΙΝΤΡΑΛΟΤ_ΕΔ.pdf  AUTOHELLAS_PROSPECTUS.pdf.crdownload

AUTOHELLAS_PROSPECTUS.pdf.crdownload

Resolution No 22 Regulation of Technical Matters for Trading on ATHEX Markets 22022024

Resolution No 22 Regulation of Technical Matters for Trading on ATHEX Markets 22022024