ATHEXClear Disclosure

ATHEXClear Disclosure

In accordance with the requirements of article 26 (7) of Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4th of July 2012 (EMIR) and article 10 of the Commission Delegated Regulation (EU) No 153/2013 of 19 December 2012 supplementing Regulation (EU) No 648/2012, ATHEXCLEAR makes available to the public, information on the governance arrangements, on its rules and regulations, on the eligible collateral and the applicable haircuts as well as a list of all current clearing members, including admission, suspension and exit criteria for clearing membership.

Governance arrangements

Organizational Structure

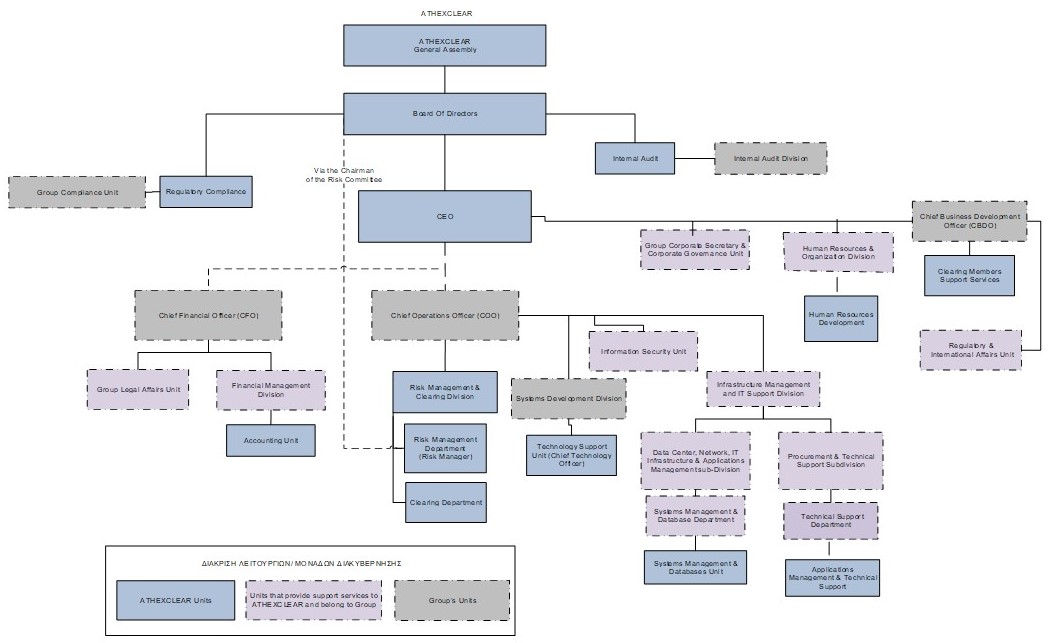

ATHEXCLEAR's functional organization combines organizational units of the companies of ATHEX Group and distinct units/governance bodies of ATHEXCLEAR:

- General Assembly (ATHEXCLEAR)

- Board of Directors (ATHEXClear)

- Board Committees

1. Supervisory Committees

- Audit Committee (ATHEXClear),

- Risk Committee (ATHEXClear),

- Committee for the Appointment of Executive, Nomination of BoD Members and Remuneration (ATHEXClear)

2. Executive Committees

- Default & Crisis Management Committee(ATHEXClear)

- Strategic Investment Committee (ATHEX Group)

- Clearing Fund Assets Management Committee (ATHEXClear)

- Information Security Management Committee (ATHEX Group)

- IT Steering Committee (ATHEX Group)

- Athens Exchange Steering Committee (ATHEX Group)

- Legal Affairs Monitoring and Coordination Committee (ATHEX Group)

- Policies Committee (ATHEX Group)

- Supervisory units

- Internal Audit Unit (ATHEXCLEAR)

- Risk Management & Clearing Division, Risk Management Department (ATHEXCLEAR)

- Compliance Unit (ATHEXCLEAR)

- Executive Units

- Risk Management & Clearing Division, Clearing Department (ATHEXCLEAR)

- IT Development Division (ATHEX Group)

- Support Functions

- Infrastructure Management and IT Support Division (ATHEXCSD)

- Human Resources & Administrative Support Division (ATHEXCSD)

- Financial Management Division (ATHEXCSD)

- Corporate Secretary & Corporate Governance Unit (ATHEX)

- Legal Affairs Unit (ATHEXCSD)

- Regulation & International Affairs Unit (ΑΤΗΕΧ)

- Clearing Member Support Services (ATHEXClear)

The schematic illustration of the above, taking into account the administrative hierarchy, the report lines and the role of each organizational unit, is presented below:

Remuneration Policy

In order to ensure competitiveness as well as stability and long-term development, ATHEXCLEAR has established, maintains and applies Remuneration Policy, that is complying with its business objectives, without compromising the level of security and maintaining ATHEXClear within standard risk limits.

Specifically, although all remuneration provided by ATHEXCLEAR is fixed, where the company decides to pay variable remuneration, the following rules hold: i) the long-term performance of the ATHEXCLEAR and its employees as well as prospective and existing risks and risk outcomes are taken into account, ii) possible mismatches of performance and risk periods are taken into account, and it is ensured that payments of variable remuneration are deferred as appropriate, iii) as regards the executives of the internal audit, risk management and compliance, variable remuneration does not depend on the business performance of the units they audit, iv) the proportion of fixed and variable remuneration is aligned with risk management, v) non-executive members of the Board of Directors receive only fixed remuneration, under the conditions laid down in ATHEXCLEAR's Articles of Association, in order to avoid conflict of interest. However, where it is deemed necessary to implement mechanisms to provide incentives when determining their remuneration, these mechanisms should be strictly adapted to the duties of those mentioned above as regards monitoring the implementation and revision of the remuneration policy, and to their personal skills and the results achieved, taking into account the institutional and oversight framework of the EMIR. Where financial instruments are given, proper measures must be taken, such as the time they are held is until the end of their term of office, in order to safeguard impartiality in their use, and vi) the fixed and variable components of total remuneration are balanced and are consistent with risk alignment.

Responsible for the prudent management of the Remuneration Policy is the Board's Nomination and Compensation Committee. The Remuneration Policy is subject to independent auditing on an annual basis.

Financial Information

You can see key financial information for ATHEXCLEAR in the analytical financial statements of ATHEXCLEAR here.

Legislation and Regulations of ATHEXCLEAR

Operating Framework

The Regulations on Clearing of Transactions on Derivatives and of Transferable Securities Transactions in Book Entry Form include information on the operating framework of ATHEXCLEAR and its procedures, namely:

- Default management procedures

- Rights and obligations of clearing members

- Description of the risks associated with using the ATHEXCLEAR's services

- Current clearing services

- Models used in margin calculations

- Use of collateral and default fund contributions

- Admission, suspension and exit criteria for clearing membership

Click here to see the Regulations on Transactions Clearing.

Pricing PolicyATHEXCLEAR's Pricing Policy as well as the detailed fees for management and use of transactions clearing systems are posted here.

Business Continuity / Disaster Recovery

The business continuity / disaster recovery plan for ATHEXCLEAR's systems and procedures is a part of the general framework for business continuity / disaster recovery of the Athens Exchange Group's operations.

Business Continuity / Disaster Recovery Procedures

In cases of malfunctioning or failure of the clearing system or other emergencies that may cause difficulties or make it impossible to carry out the obligations of ATHEXCLEAR, ATHEX Group is responsible for:

- establishing procedures and plans to achieve business continuity / disaster recovery

- having installed a disaster recovery site synchronized with its primary site with a different geographic profile than that of the main data center

- performing annually, trials of disaster scenarios in order to familiarize ATHEXCLEAR and market participants (members, data vendors, etc.) with the IT infrastructure and the activation mechanism of the Group's business continuity plan on the disaster recovery site, to the smallest possible time not exceeding two (2) hours.

Group's business continuity plan has been certified in accordance with the International Business Continuity Standard ISO-22301.

Establishment of Crisis Management and Emergency Management Groups

These groups aim to maintain the continuity of the provision of Group's services and consequently ATHEXCLEAR's in the event of an unforeseen event.

Back-up clearing systems

ATHEXCLEAR's clearing and other operations systems are installed and operate at the ATHEX Group's data center. The data center consists of two, independent of the site, the support facilities and the provided technological services, mirror data centers, so that there is redundancy and increased availability re-ensuring the uninterrupted function of ATHEXCLEAR systems.

Business impact analysis

A business impact analysis is conducted annually assessing the risk of disruption of critical operations of ATHEXCLEAR and appropriate measures are taken to mitigate this risk. This risk is monitored on an ongoing basis.

Investment Policy

ATHEXCLEAR has established Investment Policy that concerns the investments of cash (own resources and capital requirements), cash from clearing of derivatives and securities as well as safety margins (guarantees) of members.

Having as priority the security of ATHEXCLEAR funds as well as the collaterals (margins, clearing fund of derivatives and securities), ATHEXCLEAR as CCP invests all above funds only in cash in EUR and strictly at the Bank of Greece.

More information on this policy is provided in the ATHEXCLEAR's Annual Financial Report 2014, which is posted here.

Eligible Margin Collaterals and Haircuts

More information on the risk management parameters for derivatives and securities markets is posted here.

List of Clearing Members

You can see a list of clearing members here.

Policy and Procedure for Complaints Management

ATHEXCLEAR's management and staff respect the right of the persons with whom they deal, to complain about the level of services provided by ATHEXCLEAR.

With the Complaint Management Policy, ATHEXCLEAR ensures that all complaints from the clearing members are recorded and received the appropriate attention, and provision is made for them to be processed / resolved fairly, in a timely, impartial and transparent manner.

The clearing members are treated with dignity, professionalism and fairness during the process of submitting and processing their complaint and, in the event that they are not satisfied with the response given, they are provided with the necessary information and means of communication in order to reach a higher level of hierarchy or a competent body.

The process of complaints management is in compliance with the principles and rules of personal data and confidential information protection.

Any expression of dissatisfaction from clearing members about ATHEXCLEAR's performance (delays, mistakes, etc.) or failure to fulfill its obligations is considered a complaint.

- The complaint shall be submitted by the person in charge of the Clearing Member (who has the role of "membership issues") or the person in charge for clearing securities or derivatives. It is recommended that the complaint would be submitted through "Service Desk" to ensure that it would be handled in accordance with ATHEXCLEAR's procedures. The description of the complaint should be brief but at the same time sufficiently documented, accurate, containing the necessary information for being easily understood and effectively handled. Also, any accompanying explanatory documents should be attached.

- The complaint is received, investigated and answered by senior executives of ATHEXCLEAR within a reasonable time. In order to address it more effectively, further information and clarifications may be required. In any case, whether the request is described as a complaint or not, the Clearing Member will receive a documented response.

- If the Clearing Member is not satisfied with the response, it may request a reexamination of the complaint, after explaining the reasons for the non-satisfaction and submitting any additional information. The process is monitored by the ATHEXCLEAR's Compliance Unit, which operates independently of its other functions.

ATHEXClear Report on PFMI and Public Quantitative Data

ATHEXClear complies with the Principles for Financial Market Infrastructures (PFMI) published by the Committee on Payment and Settlement Systems (CPSS) and the Technical Committee of the International Organization of Securities Commissions (IOSCO) in April 2012. The detailed assesment can be viewed here: ATHEXClear REPORT on PFMI Principles.

ATHEXClear also publishes in a quartely basis quantitative data following requirements from Committee on Payment and Market Infrastructures and the International Organization of Securities Commissions (CPMI-IOSCO). The Public Quantitative Data follow:

*3Amended as of 28/01/2022

*2Amended as of 23/07/2021

*1Amended as of 05/09/2019

ATHEXClear Public Disclosure of Levels of Protection & Segregation

ATHEXClear publicly disclose the levels of protection and the costs that are connected to the different levels of segregation which it provides for clearing purposes per System as provided for under Article 39(7) of Regulation (EU) No 648/2012 and in particular in accordance with the provisions of the Rulebook of System operation "Rulebook for Clearing of Transactions in Transferable Securities in Book Entry Form" and the Rulebook of System operation "Rulebook for Clearing of Transactions in Derivatives", as adopted by the Board of Directors of ATHEXClearand and approved by the Hellenic Capital Market Commission (HCMC).

General principles underlying ATHEXClear Risk Models and Methodologies

Initial Margin and Haircut Methodology

ATHEXClear makes use of a parametric Value-at-Risk (VaR) model in order to calculate margin parameters for the securities market and input parameters for the RI.VA. system (SPAN like) used in derivatives market to calculate margins. The estimation of margin parameters is done at 1% significance level. The lookback period is twelve (12) months, while the risk horizon is two (2) to three (3) days for securities and two (2) to four (4) days for derivatives, depending on their expected liquidation period. Moreover, in order to count for pro-cyclicality a stressed period is incorporated, creating a mixed distribution with fatter tailes. Note that for Haircut Parameters the same methodology applies but at a 0.1% significance level. For the Derivatives Market the estimated parameters are incorporated into to a SPAN like model where initial margin is calculated. The input parameters for futures contracts are: (i) Valuation Interval for the underlying and the (ii) Adjustment factor, to count for maturity spreads (calendar spread); whereas for options the input parameters are: (i) Valuation Interval for the underlying instrument, (ii), Central Volatility, (iii) Change of Volatility and (iv) the Risk Free Rate.

For the Securities Market Correlations apply only among high liquid securities which are significantly and stable correlated with a benchmark index (currently only with the ATHEX FTSE/LARGE CAP Index); these securities belong to a correlation group. For securities within the correlation group, their estimated risk parameter is split in two (2) components: a general and a specific risk component, where the general component represents market risk of each security and the specific component their idiosyncratic risk. The general risk parameter is a residual parameter obtained by subtracting the specific risk parameter from the total risk parameter. Note that only securities belonging to the same Clearing Account are allowed to offset their general risk component (i.e. netting of Initial Margin); moreover only securities with opposite position signs (long/short) are allowed to offset their market risk. Initial Margin netting is not allowed in the Derivatives Market; only a maturity spread (calendar spread) among different series with the same underlying instrument apply.

Stress Test Methodology

ATHEXClear is obliged to cover on a daily basis stress test results in terms of loss as well as in terms of liquidity, arising from the default of a certain group(-s) of CM(-s) with the highest stress exposure for each market (securities, derivatives) under extreme but plausible market conditions.

As far as Counterparty Credit Risk is concerned, ATHEXClear is obliged to cover on a daily basis credit stress test results (in terms of P/L) arising from the default of the Clearing Member in which ATHEXClear has the largest risk exposure in terms of stress result (cover 2) or of the 2nd & 3rd Clearing Member if the cumulative risk exposure is higher, taking into account the dependencies of their groups (cover 2). Additionally the default of the 1st & 2nd Clearing Member with the largest cumulative risk exposure including specific own funds (SIG) shall be covered, taking into account the dependencies of their groups (cover 2). The simulated losses are net of total pledged margin collaterals.

As far as Liquidity Risk is concerned, ATHEXClear is obliged to cover on a daily basis liquidity stress test results (in terms of liquidity needs) arising from the default of the 1st & 2nd Clearing Member with the largest cumulative liquidity risk exposure for each market (securities, derivatives) taking into account the dependencies of their groups (cover 2). Liquidity needs airing from close-out of positions in case of a Clearing Member default rise within an upward sloping environment, i.e. liquidity amounts needed for physical delivery of stocks in the securities and derivatives market rise vis-a-vis stock prices. The available liquidity resources of the respective markets are (i) pledged cash collaterals of all CMs, (ii) Specific Own Resources (SIG) and (iii) Default Fund contributions. Moreover ATHEXClear could cover additional liquidity needs with its (iv) own liquidity (cash).

Stress scenarios for Counterparty Credit Risk as well as for Liquidity Risk are historical and hypothetical. In both scenario categories extreme but plausible market conditions are simulated. The main goal is to simulate extreme conditions where prices of diverse instruments move adverse with respect to CA positions as well as to simulate correlation breaks. Currently twelve (12) stress test scenarios are performed on a daily basis. Ten (10) scenarios for testing vulnerability resulting from CCR and two (2) for testing liquidity risk exposure aiming to cover all possible market constellations. Scenarios applied show the losses ATHEXClear would have to cover with own and contributed pre-funded financial resources of Clearing Members according to the default waterfall sequence as well as with own Equity Capital. The stress results are aggregated at Clearing Member Group level.

Nature of Tests Performed

On a regular basis a validation of margin models takes place. Particularly for the margin model a daily Back-testing Procedure at Clearing Account level is performed. Within the back-testing procedure a verification whether the realized price fluctuation (P/L) of positions at Clearing Account level is in line with model predictions, i.e. whether the percentage of outliers given the number of observations are greater than the significance level (α). In evaluating the outcomes a "Traffic Lights Approach" applies. Under this approach back testing results are classified into three zones, (i) Green zone: the results do not suggest a problem with the quality or reliability of the model; (ii) Amber zone: the results give rise to some questions regarding the quality or reliability of the model but firm conclusions can be drawn; and (iii) Red zone: the results almost certainly suggest a problem with the quality or reliability of the model. For Haircut Parameters the same methodology applies but at single asset level (unit back-testing).

Another validation component is the Sensitivity Analysis. According to this, several parameters of the VAR model, i.e. confidence level, correlation assumptions, Implied Volatility and significant drop in prices of cleared instruments issued by Clearing Members are progressively stressed in order to estimate their sensitivity with respect to the change in required margin. Sensitivity analysis results serve as a benchmark whether the calculated margin deviates significantly from the expected shortfall (fat tails) or whether correlation assumptions have a large offsetting effect or portfolio effect.

Reverse Stress Testing is an integral part of the robustness test of the stress framework. The aim is to simulate that market conditions that would exhaust all available financial resources of ATHEXClear before Equity Capital. The outcome serves as a benchmark check for the plausibility of stress scenarios, i.e. whether the plausibility criterion as well as the extremeness of stress scenarios are valid. The approach is to stress market prices for diverse financial instruments or/and to squeeze liquidity progressively until loss absorbing financial resources or available liquidity resources are exhausted.

High Level Summary of the Test Results for the period 01 April 2023 - 31 March 2024

Credit & Liquidity Stress-Test Results:

| Stress Test Results | Cover 1st | Cover 1st and 2nd | Cover 2nd and 3rd |

| Credit Risk | Satisfactory* | Satisfactory* | Satisfactory* |

| Liquidity Risk | Satisfactory* | Satisfactory* | Satisfactory* |

* Satisfactory result means that default fund resources were always more than stress results.

Initial Margin and Haircut Parameter Back-testing Results:

| Back-Testing Results | Result |

| IM Parameter | Satisfactory* |

| Haircut Parameter | Satisfactory* |

* Satisfactory within the respective confidence level.

ΙΝΤΡΑΛΟΤ_ΕΔ.pdf

ΙΝΤΡΑΛΟΤ_ΕΔ.pdf  AUTOHELLAS_PROSPECTUS.pdf.crdownload

AUTOHELLAS_PROSPECTUS.pdf.crdownload

Resolution No 22 Regulation of Technical Matters for Trading on ATHEX Markets 22022024

Resolution No 22 Regulation of Technical Matters for Trading on ATHEX Markets 22022024